ADX Indicator: Unveiling the Power of Market Trends

Introduction: Why Trends Matter

Have you ever noticed how the weather can change in an instant, turning a sunny day into a stormy one? Trading in financial markets can feel just like that—one minute the market goes up, the next it tumbles. That's why understanding trends is so important, and the ADX indicator is like a weather forecast for traders. In this article, I'll guide you through everything you need to know about the ADX indicator, from basics to how it fits into algo trading software—and yes, even how much those tools can cost!

Unlock the secrets of the ADX Indicator, understand what is adx indicator, and discover algo trading software price for savvy trading decisions.

What Is the ADX Indicator?

The ADX indicator stands for Average Directional Index. Think of it as a strength meter: it doesn't care if the market is going up or down, only how powerful that movement is. Created in 1978 by J. Welles Wilder, the ADX indicator helps traders spot when a trend is gaining steam or running out of energy. It's widely used because, let’s be honest, who doesn't want a head start on where the market is heading?

The Story Behind ADX: A Simple Analogy

Imagine you’re on a beach, watching waves crash. Some days, the waves barely move the sand; other days, they're strong enough to build castles or topple them. The ADX indicator is like a tool that measures how powerful the current wave (trend) is—not whether it's bringing in sand or taking it away, but how much force it’s packing.

How Does ADX Work?

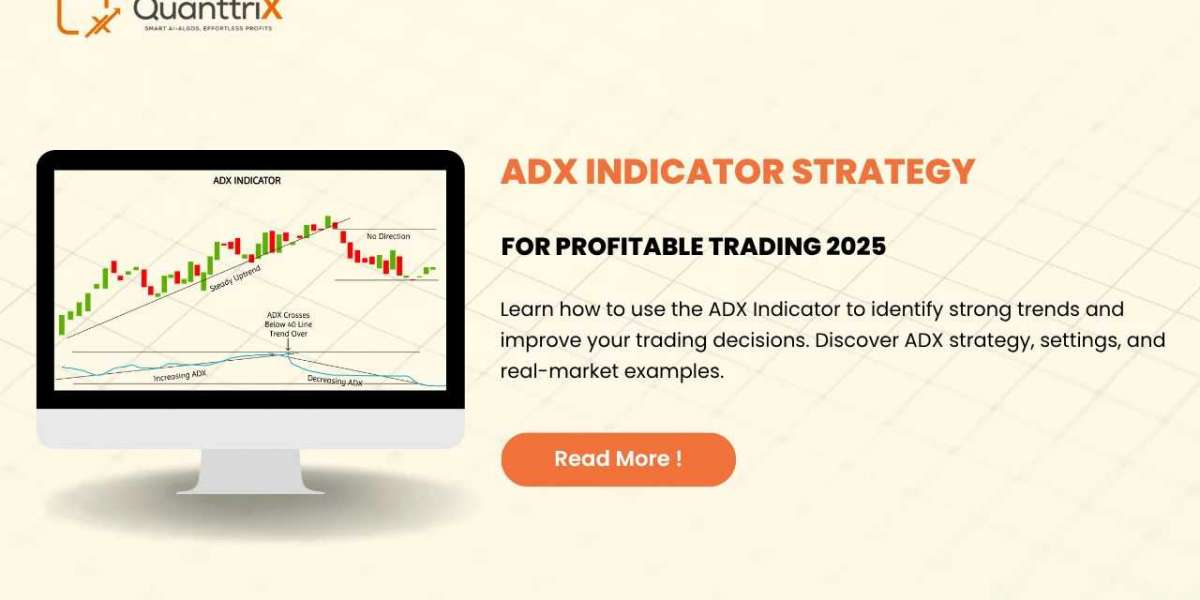

So, how does this “trend strength meter” work? The ADX is calculated using a mathematical formula that includes something called the Directional Movement Index (DMI). Without diving into complex math, the ADX blends information from price movements over a window of time (often 14 periods) to determine if there is a strong trend or just a sideways drift. The three main components are:

- +DI (Positive Directional Indicator): Measures upward strength.

- -DI (Negative Directional Indicator): Measures downward strength.

- ADX Line: Shows the overall strength of the trend, regardless of direction.

By plotting these on a chart, traders can "see" whether a trend is worth paying attention to.

Components of ADX: +DI, -DI, and ADX Line

Let’s break those down:

+DI and -DI: The Directional Siblings

- +DI tells us how much the price went up compared to the previous period.

- -DI tells us how much the price went down compared to the previous period.

When +DI is above -DI, the bulls (buyers) have the upper hand. If it's the other way around, bears (sellers) are in control.

ADX Line: The Strength Meter

The ADX line runs from 0 to 100. It doesn't show the direction (up or down), only how strong that direction is. The higher the number, the stronger the trend.

How to Read the ADX Indicator?

This is where things get practical. Here’s how you read ADX values:

- Below 20: Market trend is weak or non-existent—likely moving sideways.

- 20-25: Trend may be forming—watch closely.

- 25-50: Strong trend, traders often pay close attention here.

- Above 50: Very strong trend—possibly overextended, so caution is needed.

The real magic happens when you look at ADX alongside the +DI and -DI lines.

What Do Different ADX Values Mean?

Let's imagine you're tuning a radio:

- Weak Signal (20): Lots of static, hard to find a good station—traders might wait.

- Decent Signal (25-50): Music comes in clear, it's worth listening—traders jump in.

- Booming Signal (50): Volume is loud, but beware! Sometimes the music is so loud it could distort (overbought/oversold conditions).

You wouldn’t blast music forever, right? Similarly, very high ADX levels could mean a trend is about to cool off.

Real-Life Example: ADX in Action

Say you’re watching a stock. The +DI climbs above the -DI, and the ADX shoots up to 30. That’s a giant neon sign: “Trend Ahead!” Many traders see this as a good time to buy in, following the strength.

But if the ADX drops below 20, it could mean the party's over, and the stock might just drift sideways. Timing these shifts can make all the difference between catching a wave and wiping out.

ADX vs Other Indicators: Pros and Cons

Advantages

- Objective View: Ignores noise, focused purely on trend strength.

- Universal: Works on stocks, forex, commodities, you name it.

- Pairs Well with Others: Even better when combined with other tools like moving averages.

Drawbacks

- Lagging Indicator: Shows trend strength after a move starts, not before.

- Not Great in Ranging Markets: Less useful when the market is going sideways.

Combining ADX with Other Tools

Smart traders rarely rely on a single tool. The ADX shines when used with others:

- Moving Averages: Pinpoint trend changes.

- Relative Strength Index (RSI): Spot overbought or oversold markets.

- Price Action: Confirm what the indicators are saying.

Think of the ADX as part of your toolkit—like a mechanic using a wrench with a screwdriver.

ADX and Algo Trading: The Perfect Pair

Ever wish you had a robot assistant who could pounce on strong trends the moment they appear? That’s what happens when you plug the ADX indicator into algo trading software. Algorithms can scan markets 24/7, acting instantly when ADX conditions line up.

Why Use ADX in Algo Trading?

- Speed: No human can process information as quickly as an algorithm.

- Emotion-Free: Robots don't panic; they just follow the math.

- Custom Strategies: You can build systems that combine ADX readings with other indicators for even smarter trades.

Algo Trading Software Price: What to Expect?

If you’re thinking about dabbling in algorithmic trading, you’re probably asking: How much does it cost? Algo trading software price varies depending on features, platforms, and the level of support offered:

- Entry-level plans: Some platforms offer free or basic plans with limited features and trial periods.

- Paid plans: Can range from ₹999 to ₹18,520 per month (or higher for advanced plans), often depending on the broker and included services.

- Custom solutions: High-end, tailored strategies may cost $300 or more per setup.

- Other fees: Brokerage charges, backtesting, deployment limitations, and data access may add to the total cost.

It’s a bit like choosing a gym membership – pay only for what you need, but more advanced features can really help serious traders get an edge.

How to Choose the Right Algo Trading Software

Here’s what to think about:

- Features: Does it support ADX and other vital indicators?

- Ease of Use: Friendly interface, helpful tutorials?

- Price: Does the algo trading software price fit your budget and needs?

- Support: Is help available if you get stuck?

- Backtesting: Can you test your strategies before risking real money?

Choose wisely—good tools don’t guarantee profits, but they sure make things easier!

Common Pitfalls and Mistakes with ADX

Even the smartest indicator isn’t foolproof. Here are some mistakes to avoid:

- Overreliance: Don’t use ADX alone—always confirm with other indicators.

- Ignoring Market Context: Know when fundamental news might override technical signals.

- Chasing High ADX Readings: Sometimes, a strong trend can suddenly reverse.

- Using Wrong Settings: Default is 14 periods, but always test for your chosen market and timeframe.

Conclusion: Making the ADX Indicator Work for You

The ADX indicator demystifies one of the biggest puzzles in trading: is there a trend, and is it worth following? By using the ADX, you’ll make more informed decisions, whether you’re a hobbyist trader or someone building their first algo. Keep it simple, trust the process, and always use the ADX as part of a broader trading game plan. After all, knowing the strength of the wave means you can ride it—not get washed away!

FAQs

1. What is the ADX indicator in simple words?

The ADX indicator measures how strong a trend is, not whether prices are moving up or down. It's a tool that helps traders spot the best times to ride a market wave.

2. How do I use ADX in my trading?

Use ADX to confirm if a trend is strong enough to trade. Look for values above 25 for strength and check the +DI and -DI lines for buy or sell cues.

3. Can beginners use the ADX indicator?

Yes! The ADX indicator is simple to read and works on almost any market. Just remember to combine it with other indicators for best results.

4. What is algo trading software price in India?

Prices vary. Basic plans may be free or under ₹1,000 per month, while professional packages can cost from ₹2,999 to ₹18,520 per month or more, depending on features and brokerage.

5. Is the ADX indicator accurate?

The ADX is widely respected for measuring trend strength. It works best when paired with other tools and sound risk management.